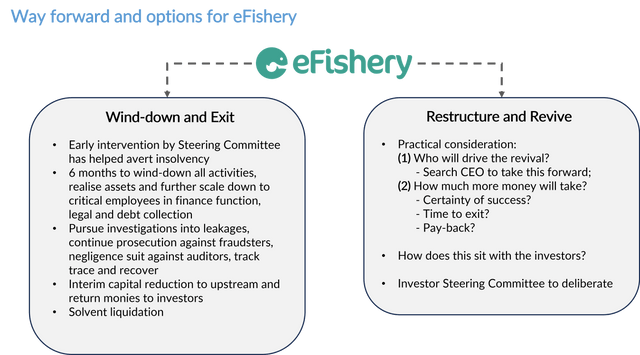

Indonesian aquaculture startup eFishery is no longer commercially viable in its current state and the bulk of its business should be shut down and its intellectual property monetised or spun off, the forensic auditors appointed to review the company have recommended.

In a draft review report, seen by DealStreetAsia, FTI Consulting has recommended that the startup’s low-margin upstream supply and downstream distribution businesses should cease. However, the intellectual property behind the technology could potentially be spun off into a new company or sold.

Following this, investors could recoup up to $42.7 million from liquidating Indonesian assets under the most optimistic scenario. This would come from assets, including cash reserves and short-term investments, at the Indonesian entities. That is just under 10 cents for every dollar invested.

There are additional cash reserves as of Feb.10, 2025, held by eFishery SG ($12.74 million), eFishery India ($1.22 million), and eFishery US ($20,000), bringing the total cash reserves across the group to $50.8 million.

However, investors could recover less after accounting for liabilities and costs related to the liquidation, including about $10 million in severance payments. Preference shareholders have priority in the distribution of assets, and ordinary shareholders are unlikely to recover their investment.

The draft report also noted that the company’s monthly cash burn was about $5 million “before intervention”, but has since been reduced to about $650,000.

The firm has terminated 90% of its employees in three phases to date while retaining only 116 staff members for critical functions.

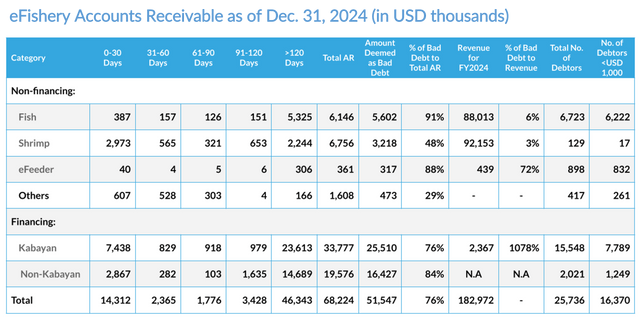

Of the total accounts receivable of $68.2 million as of Dec 31, 2024, nearly 76% of the amount is deemed as bad debt and unrecoverable. Kabayan financing makes up nearly half of the total accounts receivable, indicating weak internal controls on customer onboarding. A significant number of borrowers are located in remote areas and lack the means to repay the financing, leading to recovery challenges.

Investors in eFishery include Singapore’s Temasek, Japan’s Softbank Group, and Indonesia-focused private equity firm Northstar Group.

Top shareholders of eFishery

DATA VANTAGE

When contacted by DealStreetAsia, FTI Consulting declined to comment on the development.

Nascent tech

The ten-year-old startup, which only 18 months ago raised $200 million at unicorn valuation, began unravelling at the end of last year following whistleblower allegations of extensive fraud. The whistleblower alleges that eFishery ran on two sets of books including an ‘external’ one with faked financials that dated back to as early as 2018 during its Series A fundraising.

“As things stand today, it may be challenging to provide an assurance that the latest internal books are 100% accurate,” the draft report noted.

Out of $314 million raised over five fund runs, only $8.5 million, or approximately 2.7% was channelled into developing the technology. Another $8 million is still needed to achieve full technological integration, the draft report noted.

eFishery’s business model connected fish and shrimp farmers with suppliers of feed and fingerlings on one end, and to buyers at the other. Financial institutions would help fund the technology-driven cultivation system, designed to automate feeding, monitor pond activity, match buyers and yields, and provide predictive modelling according to the farmers’ needs.

But it has since been discovered that the technology remains in its nascent stage, with only 6,300 eFeeders deployed (5,300 on rental and 1,000 from one-time acquisition)—far below the reported 400,000—and there are no sensing devices in ponds to relay vital data.

“eFishery is essentially operating as a supplier of feed, non-feed items (e.g. probiotics and vitamins) and fingerlings to farmers in the upstream cycle and as a trader of both fish and shrimps at the downstream cycle. Both of which are traditional businesses that are labour-intensive and low yield,” the draft report said.

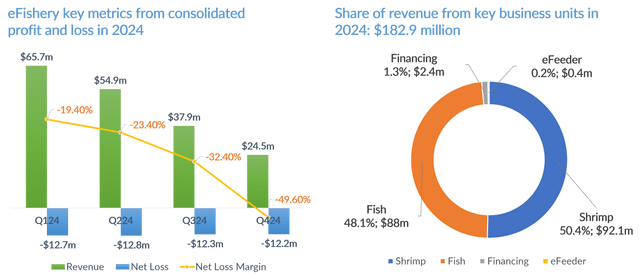

The company’s total revenue dropped to 35.3% $24.5 million in Q4 from $37.9 million in the previous quarter, while the net losses narrowed marginally to $12.2 million in Q4 from $12.3 million in the previous quarter.

The shrimp and fish segments have been the major revenue generators for the company, with the shrimp segment accounting for more than half of the company’s revenue in 2024, followed by the fish segment contributing 48%. Financing and e-feeder segments could generate just around 1% of the revenue.

All the four segments suffered losses in 2024. The fish segment made losses of $9.9 million, the highest among these business segments, while the eFeeder segment suffered the highest net loss margin.

FTI Consulting’s senior managing director in the corporate restructuring practice Martin Wong has since been appointed as eFishery’s interim CEO. FTI’s objective has been to conserve residual cash through various cost-cutting initiatives and evaluate a viable course for the company.

Earlier this month, a police report was filed in Indonesia against co-founders and former directors Gibran Huzaifah and Chrisna Aditya.

Gita Rossiana contributed to the story