Singapore-listed real estate asset manager CapitaLand Investment Limited (CLI) is taking a minority stake in smart-warehouse developer Ally Logistics Property (ALP) and also committing S$260 million (about $202 million) to build an automated facility in the city-state.

In a statement, CLI said the two moves are part of its efforts to step up its push into automated logistics across the Asia Pacific region, reflecting its confidence in the long-term fundamentals of the logistics sector.

CLI said ALP, an existing partner in its Southeast Asia logistics fund, would deepen its operational capabilities in logistics automation and support expansion into markets, including Australia, Japan, and the US.

ALP focuses on so-called “smart logistics” infrastructure, integrating automation, robotics and artificial intelligence through its OMEGA platform to support warehousing, distribution and supply-chain operations.

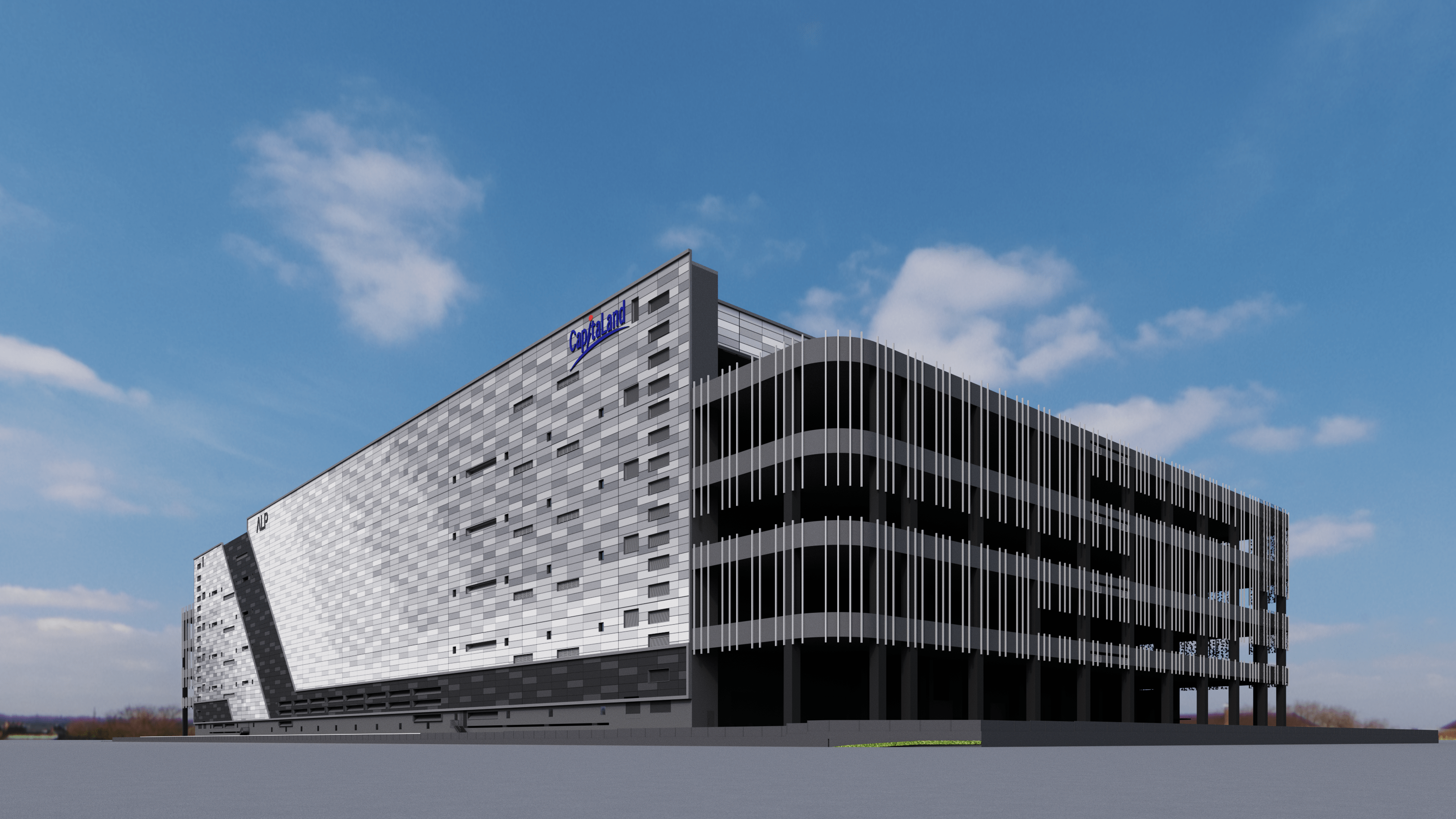

For its automated logistics facility “OMEGA 1 Singapore”, CLI has acquired a 5.1-hectare site at 19 Gul Lane in Singapore’s Jurong Industrial Estate through its CapitaLand Southeast Asia Logistics Fund. The five-storey automated logistics facility is expected to be completed in 2028.

The building will have about 71,000 square metres of gross floor area and capacity for roughly 60,000 pallet positions, and will be fully leased to ALP under a long-term master lease with built-in rent escalation, the company said.

“Structural drivers such as the growth in digitally enabled consumption, ageing population, rising labour costs and supply chain rationalisation continue to fuel demand for modern, automated logistics solutions across the region,” Patricia Goh, CLI’s CEO for Southeast Asia and global head of logistics and self-storage for private funds, said in a statement.

CLI has deployed around S$500 million into logistics developments across Southeast Asia over the past two years, Goh added.

Launched in 2022, CLI’s Southeast Asia logistics fund invests in and develops logistics assets across the region. After the Singapore project, the fund’s assets under management will be split 55% in Singapore, with the remainder in Thailand and Vietnam, CLI said.

In Thailand, the fund is developing “OMEGA 1 Bang Na” on a 20-hectare site in Greater Bangkok, with phase 1 expected to be completed in mid-2026.

In Vietnam, it broke ground in September 2025 on a ready-built factory at Song Khoai Industrial Park in Quang Ninh, with full completion expected in the first half of 2026, CLI added.