Following DealStreetAsia’s exclusive report on Indonesian unicorn eFishery’s co-founders being suspended by the board, questions are being raised about its fallout on the Indonesian startup ecosystem.

The report, published on Sunday (Oct. 15) and confirmed by the company the following day, has shone the spotlight on governance lapses plaguing startups in the archipelago and may further damage investor confidence, especially in late-stage startups.

eFishery said it suspended its co-founders Gibran Huzaifah and Chrisna Aditya amid an investigation into “financial misreporting of performance and revenue”.

Many in the startup ecosystem expressed disappointment. “This has hurt market sentiment towards startups,” an industry insider told DealStreetAsia. “It’s sad to see this happening,” added another source under the condition of anonymity.

The startup-focused social media platform ecommurz was abuzz with posts on the issue.

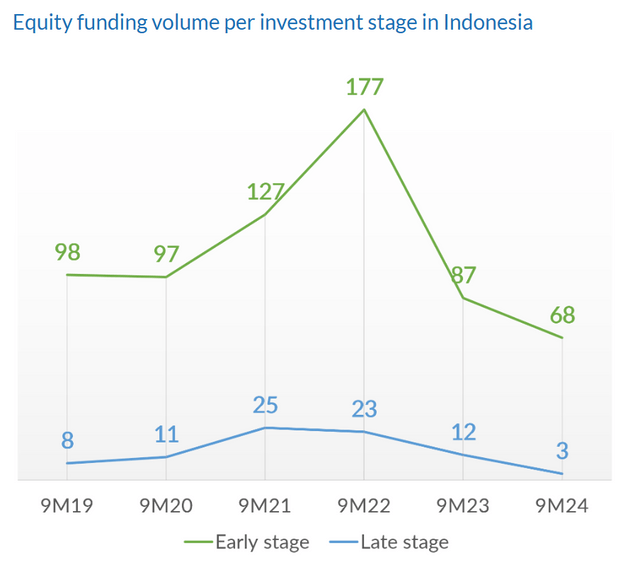

The development also comes as startup funding in Indonesia plummeted to a six-year low in the third quarter of 2024, according to DealStreetAsia DATA VANTAGE‘s SE Asia Deal Review: Q3 2024 report.

Dealmaking activity was dry in the late stages, in particular. Only three late-stage Indonesian startups raised funds in the first nine months of 2024, compared with 12 in the year-ago period, according to the report.

Nailul Huda, director at the Center of Economic and Law Studies (CELIOS), said: “This [the developments at eFishery] will certainly affect investors’ interest. The more cases like this that arise, the lower the investor interest will be because ESG principles — particularly corporate governance — are key investment criteria.” Huda added that investors are increasingly stepping in to fix governance issues within startups, recognising that proper oversight is essential for long-term stability.

However, adhering to good governance principles involves striking a fine balance. “Efforts to protect financial performance must not come at the expense of a startup’s purpose and spirit of innovation,” Huda said.

eFishery’s relationship with global banks like HSBC has added another layer of complexity to the crisis. The startup had secured a $30 million green and social loan from HSBC Indonesia for its expansion plans in May this year.

Multiple sources aware of the development said the bank may be reviewing the loan arrangement. HSBC declined to comment when contacted by DealStreetAsia.

Argor Capital Management (formerly Go-Ventures) had plans to increase its stake in eFishery by closing a $70-million continuation fund, DealStreetAsia had reported. The continuation vehicle is designed to acquire the firm’s existing stake and also purchase stakes from other investors who had agreed to sell, sources had said.

The fate of the continuation fund remains unclear. Argor Capital declined to comment for this report.

Prominent investors, including Northstar, Wavemaker Partners, Temasek Holdings, Argor Capital, and SoftBank, have also backed eFishery.

Top shareholders of eFishery

eFishery’s troubles have dented the optimism surrounding local startups, especially those aiming for IPOs or higher valuations. A venture capitalist said, “eFishery represented hope for Indonesia’s startup ecosystem. Its strong performance over the past two years gave us confidence, but now it feels like that momentum is gone.”

Jeffrey Bahar from YAMADA Consulting & Spire opined that the IPO plans of startups will not be significantly affected by this case. However, he pointed out that the P2P lending sector, currently facing challenges such as fraud allegations in some companies, layoffs, and issues with lenders, is unlikely to recover smoothly. Local and international investors remain highly cautious about this sector.

Mismanagement of loan repayments?

While eFishery’s operational issues, such as unrepaid loans from farmers, have been widely discussed, an industry source suggested that the company’s officers may have failed to deposit payments made by farmers into the company’s accounts, suggesting a possible misappropriation of funds.

The aquatech startup’s VP of Governance, Risk & Compliance (GRC) Mazlan Hashim had acknowledged in September that instances of fraud do occur when field officers fail to deposit farmers’ payments for fish feed directly into the bank. These incidents, he had said, were more common in rural areas with poor internet connectivity and where farmers were mostly unbanked.

Bahar from YAMADA Consulting believes eFishery has been using the right business model by collaborating with P2P lending players to provide financing for fish farmers. Therefore, the issues within the company may not stem from its business model but could instead be internal.

Additionally, the challenges facing the peer-to-peer (P2P) lending industry may likely have impacted eFishery. “It could be a spillover effect from the P2P industry, which is currently facing problems, besides, there are compliance issues in the firm,” he told DealStreetAsia.

However, insiders argue that these problems alone do not explain the suspension of the company’s top leaders. “Unpaid loans are significant but should have been manageable with proper intervention. The drastic action taken suggests deeper governance and irregularities within the company,” said a source.

“We are worried whether farmers will be able to repay their loans after this incident,” said another source in the fintech industry.

eFishery’s fintech feature Kabayan — a buy now pay later (BNPL) scheme for fish farmers — was introduced in 2020. It partners with fintechs and banks like JULO, Kredivo, Amartha, and others to facilitate this initiative.

By eFishery’s 10th anniversary in Oct 2023, Kabayan had disbursed over 1.07 trillion rupiah ($105.3 million) to around 24,000 fish farmers. In Jan-July 2024 alone, Kabayan disbursed more than 180 billion rupiah ($11.1 million) to 6,000 farmers.

While most fintech partners declined to comment when contacted by DealStreetAsia, Harumi Supit, VP of public relations at Amartha, stated: “We have very little exposure. To date, there has been no issue with the portfolio.”

eFishery’s decision to hire 1,500 sales staff in 2022, significantly more than its competitors, may have led to governance issues at the operational level, a source added. In July, it laid off an undisclosed number of employees, citing “structural adjustments”.

The company declined to comment on the matter. DealStreetAsia has reached out to Gibran Huzaifah for comment.

A sector in trouble

The eFishery case has exposed vulnerabilities in the agritech and aquatech sectors and raised questions about financial transparency, governance, and accountability. Governance lapses have been a major pain point for several startups in the sector.

FishLog, another fishery startup, downsized its workforce by more than half and is exploring a strategic M&A option, DealStreetAsia reported in October. The company has undergone multiple rounds of layoffs, coming down from about 250 employees at the end of 2022 to 85, then around 35 as of October, sources had said.

Meanwhile, agritech startup EdenFarm has been grappling with operational difficulties and conducted its third round of layoffs in February 2024.

In another instance, Indonesia’s Financial Services Authority (OJK) revoked the business licence of the agritech P2P fintech lending platform TaniFund, after the company failed to meet minimum equity requirements.

Another dramatic governance lapse involved Investree, which was considered a potential unicorn. The fintech firm’s licences were revoked by OJK in October due to multiple violations of regulatory policies.

The OJK does not have the authority to supervise eFishery directly but will oversee the P2P lending platforms and financial services that collaborate with the company. Investors have exercised their rights to inquire about eFishery’s business operations and have requested an internal audit of the company.

Despite the issues within eFishery, Bahar expressed hope that more aquatech players will emerge in the country, as this sector is crucial for supporting fish farmers who face challenges in their distribution and production systems. He also highlighted the importance of late-stage startups learning from this case, urging them to grow sustainably by avoiding reckless spending and more focus on compliance.

By restructuring and enhancing its brand presence in the market, eFishery may also be able to realise its plan to go public, he added.